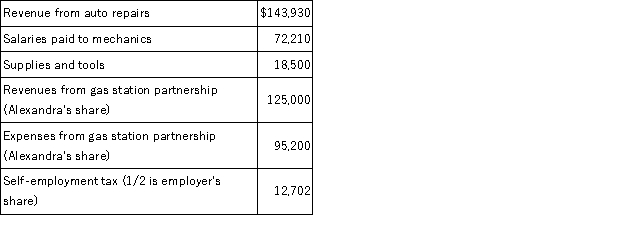

Alexandra operates a garage as a sole proprietorship. Alexandra also owns a half interest in a partnership that operates a gas station. This year Alexandra paid or reported the following expenses related to her garage and other property. Determine Alexandra's AGI for 2016.

Correct Answer:

Verified

Explanation: All of th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: Which of the following is a miscellaneous

Q78: Margaret Lindley paid $15,000 of interest on

Q79: Opal fell on the ice and injured

Q80: Madeoff donated stock (capital gain property) to

Q81: Which of the following itemized deductions is

Q82: Chuck has AGI of $70,000 and has

Q84: Constance currently commutes 25 miles from her

Q86: Scott is a self-employed plumber and his

Q88: Grace is employed as the manager of

Q106: Last year Henry borrowed $15,000 to help

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents