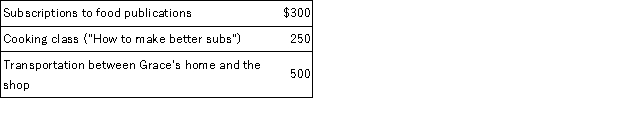

Grace is employed as the manager of a sandwich shop. This year she earned a salary of $45,000 and incurred the following expenses associated with her employment:

What amount of miscellaneous itemized deductions can Grace claim on Schedule A if these are her only miscellaneous itemized deductions?

A) $150.

B) $1,050.

C) $550.

D) $200 if Grace was reimbursed $50 for her cooking class.

E) None of the abovE.The subscriptions and cooking class ($550) are deductible but this sum is reduced to zero by the 2 percent of AGI limitation ($900) .

Correct Answer:

Verified

Q43: Frieda is 67 years old and deaf.

Q54: Which of the following is a miscellaneous

Q83: Alexandra operates a garage as a sole

Q84: Constance currently commutes 25 miles from her

Q86: Scott is a self-employed plumber and his

Q89: Detmer is a successful doctor who earned

Q90: Andres and Lakeisha are married and file

Q91: Shelby is working as a paralegal while

Q100: This year Tiffanie files as a single

Q106: Last year Henry borrowed $15,000 to help

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents