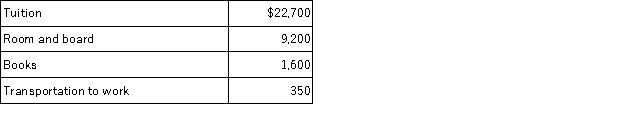

Shelby is working as a paralegal while attending law school at night. This year she has incurred the following expenses associated with school.

What amount can Shelby deduct as an employee business expense if her modified AGI this year is $25,000?

Correct Answer:

Verified

Explanation: The tuition,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Frieda is 67 years old and deaf.

Q54: Which of the following is a miscellaneous

Q86: Scott is a self-employed plumber and his

Q88: Grace is employed as the manager of

Q89: Detmer is a successful doctor who earned

Q90: Andres and Lakeisha are married and file

Q94: Which of the following is a true

Q96: Kaylee is a self-employed investment counselor who

Q100: This year Tiffanie files as a single

Q108: Collin and Christine are married and file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents