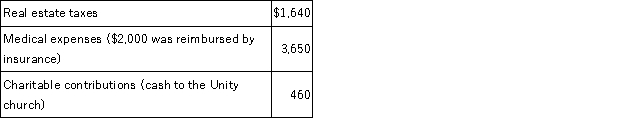

Bryan is 67 years old and lives alone. This year he has received $25,000 in taxable interest and pension payments, and he has paid the following expenses:

If Bryan files single with one personal exemption, calculate his taxable income.

Correct Answer:

Verified

Expl...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Claire donated 200 publicly-traded shares of stock

Q64: Justin and Georgia file married jointly with

Q87: This year,Benjamin Hassell paid $20,000 of interest

Q96: Kaylee is a self-employed investment counselor who

Q97: Which of the following is a true

Q99: Homer is an executive who is paid

Q100: Jenna (age 50) files single and reports

Q104: Colby is employed full time as a

Q106: Clark is a registered nurse and full

Q110: This year Kelly bought a new auto

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents