Consider the following to answer the question(s) below:

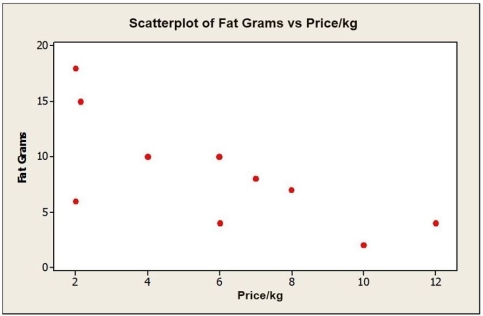

A consumer research group investigating the relationship between the price of meat (per kilogram) and the fat content (grams) gathered data that produced the following scatterplot.

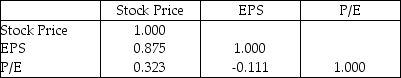

-Shown below is a correlation table showing correlation coefficients between stock price, earnings per share (EPS) , and the price/earnings (P/E) ratio for a sample of 19 publicly traded companies. Which of the following statements is false? Correlation: Stock Price, EPS, P/E

A) Since r = 0.323 for P/E and Stock Price, there is a relatively weak positive correlation between P/E and Stock Price.

B) The strongest correlation is between EPS and Stock Price.

C) There is a weak negative correlation between P/E and EPS.

D) The strongest correlation is between P/E and Stock Price.

E) The weakest correlation is between P/E and EPS.

Correct Answer:

Verified

Q22: Consider the following to answer the question(s)

Q23: Consider the following to answer the question(s)

Q24: Consider the following to answer the question(s)

Q25: Consider the following to answer the question(s)

Q26: Consider the following to answer the question(s)

Q27: Consider the following to answer the question(s)

Q28: Consider the following to answer the question(s)

Q29: Consider the following to answer the question(s)

Q30: Consider the following to answer the question(s)

Q31: Consider the following to answer the question(s)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents