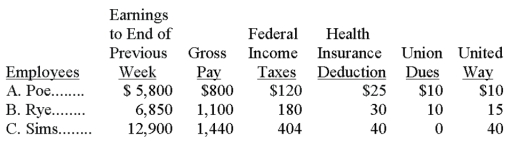

The payroll records of a company provided the following data for the current weekly pay period ended March 7.  Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Correct Answer:

Verified

Q143: A company sells computers with a 6-month

Q144: Pastimes Co. offers its employees a bonus

Q154: Ember Co. entered into the following transactions

Q162: Times interest earned is computed by dividing

Q177: A company's payroll information for the month

Q179: A company's employer payroll tax rates are

Q186: The difference between the amount borrowed and

Q190: Gross pay less all deductions is called

Q205: To compute the amount of tax withheld

Q206: Companies with many employees often use a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents