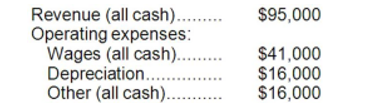

(Ignore income taxes in this problem.) The Halsey Corporation is contemplating the purchase of new equipment that would require an initial investment of $125,000. The equipment would have a useful life of six years, with a salvage value of $29,000. This new equipment would be depreciated over its useful life by the straight-line method. It would replace existing equipment which is fully depreciated. The existing equipment has a salvage value now of $38,000. The anticipated annual revenues and expenses associated with the new equipment are:

Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project.

-For this investment, the simple rate of return to the nearest tenth of a percent is:

A) 43.7%

B) 25.3%

C) 30.4%

D) 17.6%

Correct Answer:

Verified

Q104: (Ignore income taxes in this problem.) The

Q105: (Ignore income taxes in this problem.) Chee

Q106: (Ignore income taxes in this problem.) Carlson

Q107: (Ignore income taxes in this problem.) The

Q108: (Ignore income taxes in this problem.) Pro-Mate,

Q110: (Ignore income taxes in this problem.) Pro-Mate,

Q111: (Ignore income taxes in this problem.) Jimba's,

Q112: (Ignore income taxes in this problem.) The

Q113: (Ignore income taxes in this problem.) The

Q114: (Ignore income taxes in this problem.) Overland

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents