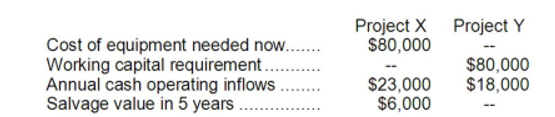

(Ignore income taxes in this problem.) The Sawyer Corporation has $80,000 to invest and is considering two different projects, X and Y. The following data are available on the projects:

Both projects will have a useful life of 5 years; at the end of 5 years, the working capital will be released for use elsewhere. Sawyer's discount rate is 12%.

-The net present value of project Y is closest to:

A) $15,110

B) $30,250

C) $11,708

D) $(11,708)

Correct Answer:

Verified

Q99: (Ignore income taxes in this problem.) The

Q100: (Ignore income taxes in this problem.) Wombles

Q101: (Ignore income taxes in this problem.) Jimba's,

Q102: (Ignore income taxes in this problem.) Clairmont

Q103: (Ignore income taxes in this problem.) Chee

Q105: (Ignore income taxes in this problem.) Chee

Q106: (Ignore income taxes in this problem.) Carlson

Q107: (Ignore income taxes in this problem.) The

Q108: (Ignore income taxes in this problem.) Pro-Mate,

Q109: (Ignore income taxes in this problem.) The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents