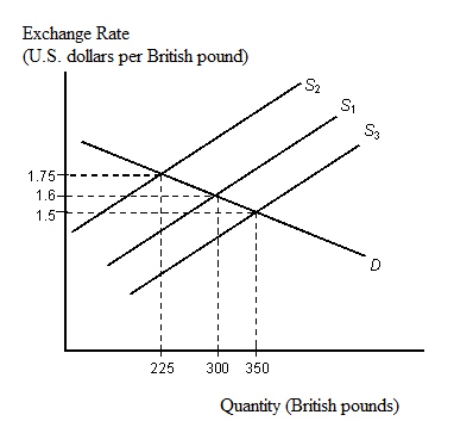

The figure given below depicts the foreign exchange market for British pounds traded for U.S.dollars. Figure 22.2  Refer to Figure 22.2.Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3.According to the Bretton Woods agreement:

Refer to Figure 22.2.Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3.According to the Bretton Woods agreement:

A) the pound should be devalued.

B) the dollar should be devalued.

C) the British central bank should buy pounds in exchange for dollars.

D) the British central bank should encourage speculation.

E) the Fed should intervene to maintain the exchange rate of £1 = $1.

Correct Answer:

Verified

Q43: In 1991,the French mineral water Perrier was

Q45: The figure given below depicts the demand

Q47: The supply of Thai baht in the

Q47: The figure given below depicts the demand

Q48: The figure given below depicts the foreign

Q51: Suppose a hefty rise in the demand

Q51: The figure given below depicts the foreign

Q52: The figure given below depicts the demand

Q53: The figure given below depicts the demand

Q60: The figure given below depicts the demand

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents