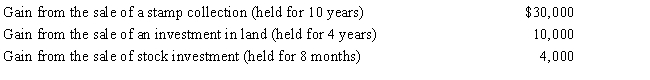

Perry is in the 33% tax bracket. During 2016, he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

A) (15% × $30,000) + (33% × $4,000) .

B) (15% × $10,000) + (28% × $30,000) + (33% × $4,000) .

C) (0% × $10,000) + (28% × $30,000) + (33% × $4,000) .

D) (15% × $40,000) + (33% × $4,000) .

E) None of these.

Correct Answer:

Verified

Q38: The taxpayer's marginal tax bracket is 25%.

Q53: Swan Finance Company, an accrual method taxpayer,

Q76: Doug and Pattie received the following interest

Q78: Heather's interest and gains on investments for

Q81: Sharon made a $60,000 interest-free loan to

Q83: Kirby is in the 15% tax bracket

Q84: During the year, Irv had the following

Q90: Hazel, a solvent individual but a recovering

Q91: Gold Company was experiencing financial difficulties, but

Q109: Margaret made a $90,000 interest-free loan to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents