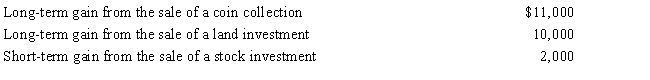

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2016:

Kirby's tax consequences from these gains are as follows:

A) (5% × $10,000) + (15% × $13,000) .

B) (15% × $13,000) + (28% × $11,000) .

C) (0% × $10,000) + (15% × $13,000) .

D) (15% × $23,000) .

E) None of these.

Correct Answer:

Verified

Q38: The taxpayer's marginal tax bracket is 25%.

Q78: Heather's interest and gains on investments for

Q81: Perry is in the 33% tax bracket.

Q81: Sharon made a $60,000 interest-free loan to

Q84: During the year, Irv had the following

Q90: Hazel, a solvent individual but a recovering

Q91: Gold Company was experiencing financial difficulties, but

Q107: Determine the proper tax year for gross

Q109: Margaret made a $90,000 interest-free loan to

Q117: Roy is considering purchasing land for $10,000.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents