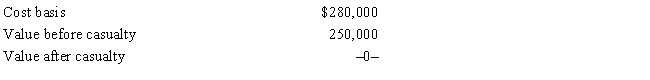

In 2016, Grant's personal residence was completely destroyed by fire. Grant was insured for 100% of his actual loss, and he received the insurance settlement. Grant had adjusted gross income, before considering the casualty item, of $30,000. Pertinent data with respect to the residence follows:

What is Grant's allowable casualty loss deduction?

A) $0

B) $6,500

C) $6,900

D) $10,000

E) $80,000

Correct Answer:

Verified

Q40: In 2015,Arnold invests $80,000 for a 20%

Q44: Tara owns a shoe store and a

Q46: Last year, Ted invested $100,000 for a

Q52: In 2015,Kipp invested $65,000 for a 30%

Q58: White Corporation,a closely held personal service corporation,has

Q63: Ahmad owns four activities. He participated for

Q64: Norm's car,which he uses 100% for personal

Q69: Alma is in the business of dairy

Q79: Rick, a computer consultant, owns a separate

Q97: Matt has three passive activities and has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents