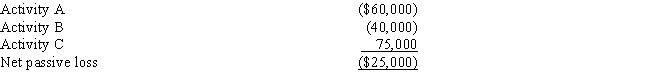

Matt has three passive activities and has at-risk amounts in excess of $100,000 for each. During the year, the activities produced the following income (losses) .

Matt's suspended losses are as follows:

A) $25,000 is allocated to C; $0 to A and B.

B) $12,500 is allocated to A; $12,500 to B.

C) $15,000 is allocated to A; $10,000 to B.

D) $8,333 is allocated to A, B, and C.

E) None of the above.

Correct Answer:

Verified

Q40: In 2015,Arnold invests $80,000 for a 20%

Q58: White Corporation,a closely held personal service corporation,has

Q63: Ahmad owns four activities. He participated for

Q64: Norm's car,which he uses 100% for personal

Q69: Alma is in the business of dairy

Q78: Josh has investments in two passive activities.Activity

Q79: Rick, a computer consultant, owns a separate

Q91: If a taxpayer has a net operating

Q94: In 2016, Grant's personal residence was completely

Q101: Tonya had the following items for last

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents