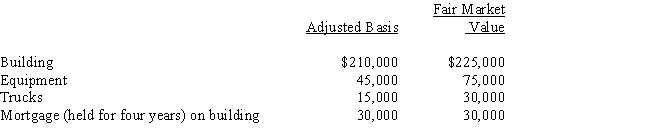

Rick transferred the following assets and liabilities to Warbler Corporation.

In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

A) Rick has a recognized gain of $60,000.

B) Rick has a recognized gain of $75,000.

C) Rick's basis in the stock of Warbler Corporation is $270,000.

D) Warbler Corporation has the same basis in the assets received as Rick does in the stock.

E) None of the above.

Correct Answer:

Verified

Q53: Three individuals form Skylark Corporation with the

Q62: Erica transfers land worth $500,000, basis of

Q63: Dawn, a sole proprietor, was engaged in

Q65: Rhonda and Marta form Blue Corporation. Rhonda

Q68: Earl and Mary form Crow Corporation. Earl

Q69: Joe and Kay form Gull Corporation. Joe

Q74: Leah transfers equipment (basis of $400,000 and

Q77: In order to induce Yellow Corporation to

Q80: Rachel owns 100% of the stock of

Q112: Four individuals form Chickadee Corporation under §

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents