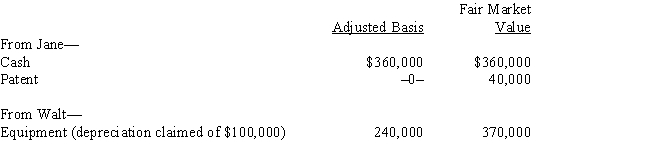

Four individuals form Chickadee Corporation under § 351. Two of these individuals, Jane and Walt, made the following contributions:

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000; Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000; Jane has no income.

D) Walt must recognize income of $100,000; Jane has no income.

E) None of the above.

Correct Answer:

Verified

Q55: Kevin and Nicole form Indigo Corporation with

Q62: Erica transfers land worth $500,000, basis of

Q63: Dawn, a sole proprietor, was engaged in

Q67: Wade and Paul form Swan Corporation with

Q70: Carl transfers land to Cardinal Corporation for

Q77: In order to induce Yellow Corporation to

Q80: Rachel owns 100% of the stock of

Q107: Rick transferred the following assets and liabilities

Q116: Dick, a cash basis taxpayer, incorporates his

Q117: Rob and Fran form Bluebird Corporation with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents