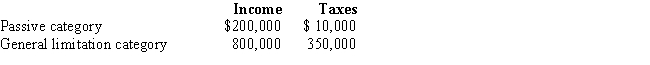

Britta, Inc., a U.S. corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $560,000 (assume a 35% tax rate). What is Britta's U.S. tax liability after the FTC?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: General Corporation is taxable in a number

Q70: General Corporation is taxable in a number

Q79: General Corporation is taxable in a number

Q109: Given the following information, determine if FanCo,

Q110: Dott Corporation generated $300,000 of state taxable

Q114: Ting, a regional sales manager, works from

Q115: Compute Still Corporation's State Q taxable income

Q116: Boot Corporation is subject to income tax

Q117: Flip Corporation operates in two states, as

Q135: Present,Inc.,a U.S.corporation,owns 60% of the stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents