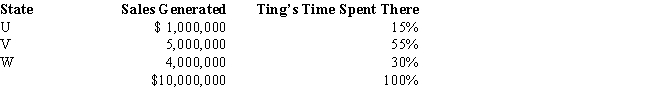

Ting, a regional sales manager, works from her office in State W. Her region includes several states, as indicated in the sales report below. Determine how much of Ting's $300,000 compensation is assigned to the payroll factor of State W.

A) $0.

B) $90,000.

C) $120,000.

D) $300,000.

Correct Answer:

Verified

Q63: General Corporation is taxable in a number

Q70: General Corporation is taxable in a number

Q109: Given the following information, determine if FanCo,

Q110: Dott Corporation generated $300,000 of state taxable

Q112: Britta, Inc., a U.S. corporation, reports foreign-source

Q115: Compute Still Corporation's State Q taxable income

Q116: Boot Corporation is subject to income tax

Q117: Flip Corporation operates in two states, as

Q118: Hill Corporation is subject to tax only

Q119: Mercy Corporation, headquartered in State F, sells

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents