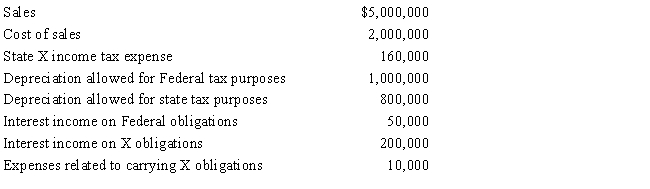

Hill Corporation is subject to tax only in State X. Hill generated the following income and deductions. State income taxes are not deductible for X income tax purposes.

a.The starting point in computing the State X income tax base is Federal taxable income. Derive this amount.

b.Determine Hill's State X taxable income, assuming that interest on X obligations is exempt from State X income tax.

c.Determine Hill's taxable income, assuming that interest on X obligations is subject to State X income tax.

Correct Answer:

Verified

Q62: The throwback rule requires that:

A) Sales of

Q70: General Corporation is taxable in a number

Q114: Ting, a regional sales manager, works from

Q115: Compute Still Corporation's State Q taxable income

Q116: Boot Corporation is subject to income tax

Q117: Flip Corporation operates in two states, as

Q119: Mercy Corporation, headquartered in State F, sells

Q126: Discuss the primary purposes of income tax

Q189: State Q wants to increase its income

Q191: Your supervisor has shifted your responsibilities from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents