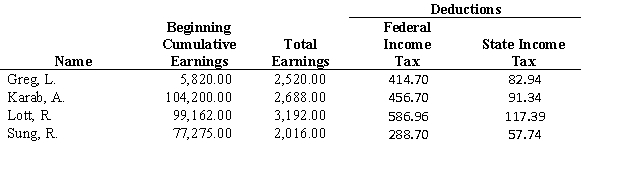

Ice Cold Storage has the following payroll information for the week ended November 20. State income tax is computed as 20 percent of federal income tax. Use page 77 for general journal.

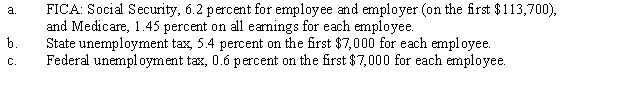

Assumed tax rates are as follows:

Assumed tax rates are as follows:

Instructions:

Instructions:

1.Complete the payroll register. Payroll checks begin with Ck. No. 6307 in the payroll register.

2.Prepare a general journal entry to record the payroll as of November 20. The company's general ledger contains a Salary Expense account and a Salaries Payable account.

3.Prepare a general journal entry to record the payroll taxes as of November 20.

4.Journalize the entry to pay the payroll on November 22. (Assume that the company has transferred cash to the Cash-Payroll Bank Account for this payroll.)

Correct Answer:

Verified

Q70: By January 31, an employer must furnish

Q74: The source of the amounts used to

Q77: The details of the current week's earnings

Q82: Match the terms that follow with the

Q83: Explain the difference between Form W-2 and

Q89: Match the terms that follow with the

Q91: Match the terms that follow with the

Q92: Match the terms that follow with the

Q101: Hardy Company has the following balances in

Q103: Wilson Construction Company receive and paid a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents