Hardy Company has the following balances in its general ledger as of September 1 of this year:

1.FICA Taxes Payable (liability for August), $1,150.00 (employee and employer).

2.Employees' Federal Income Tax Payable (liability for August), $908.00.

3.Federal Unemployment Tax Payable (liability for July and August), $215.00.

4.State Unemployment Tax Payable (liability for July and August), $1,262.75.

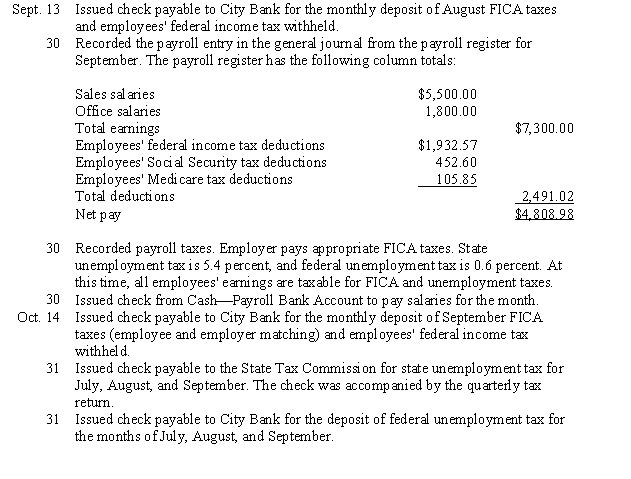

The company completed the following transactions involving the payroll during September and October:

Instructions:

Instructions:

Record the transactions in the general journal, pages 41-42.

Correct Answer:

Verified

Q70: By January 31, an employer must furnish

Q74: The source of the amounts used to

Q77: The details of the current week's earnings

Q82: Match the terms that follow with the

Q83: Explain the difference between Form W-2 and

Q89: Match the terms that follow with the

Q91: Match the terms that follow with the

Q92: Match the terms that follow with the

Q102: Ice Cold Storage has the following payroll

Q103: Wilson Construction Company receive and paid a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents