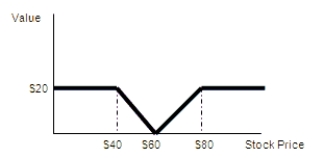

Combining options: Suppose you are creating a portfolio that consists of zero-interest bonds, stock from a single company, and call and put options on the stock. Holding which of the following combination of securities will give the payoff shown in the following diagram?

A) Buy one call option and one put option on the stock with a strike price of $60.

B) Buy one call option with a strike price of $60 and sell short one call option with a strike price of $80. Buy one put option at a strike price at $60 and sell short one put option with a strike price of $40.

C) Buy one share of the underlying stock. In addition, buy two call options, one with a $40 strike price, and one with a $80 strike price.

D) Buy one share of the underlying stock, and a put option with a strike price of $60. Sell short call two call options-one with a strike price of $40 and one with a strike price of $80.

Correct Answer:

Verified

Q84: Binomial pricing: Assume that the stock of

Q84: Risk management: Consider a wheat farmer who

Q85: Risk management: OilDog Co. is a privately

Q86: Binomial pricing: Assume that the stock of

Q87: Binomial pricing: Assume that the stock of

Q88: Real options: Consider a lease agreement recently

Q90: Binomial pricing: Assume that the stock of

Q91: Binomial pricing: Assume that the stock of

Q92: Combining options: Suppose you are creating a

Q93: Binomial pricing: Assume that the stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents