Capital budgeting computations

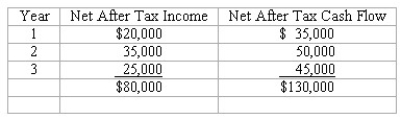

A project costing $80,000 has an estimated life of 3 years and no salvage value.The estimated net income and net after tax cash flows from the project are as follows:  The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751,respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751,respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

Compute

(a)Net present value of the project.________

(b)The rate of return on average investment ________(rounded)

Calculations

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Discounting cash flows

Determine the present value of

Q85: Return on average investment vs.discounting cash flows

The

Q86: When using the net present value method

Q87: Capital budgeting

Carry-Along is debating whether or not

Q88: Capital budgeting

Mason Co.is evaluating two alternative investment

Q90: Carter & Co.is trying to decide which

Q91: The accuracy of capital budget decisions is

Q92: Capital budget audit

Briefly discuss the reasons that

Q93: Capital budgeting

Flynn Corporation is debating whether to

Q94: Capital budgeting

Golden Flights,Inc.is considering buying some specialized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents