Capital Budgeting Mason Co.is Evaluating Two Alternative Investment Proposals.Below Are Data for Data

Capital budgeting

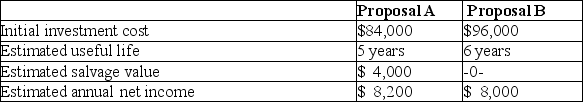

Mason Co.is evaluating two alternative investment proposals.Below are data for each proposal:

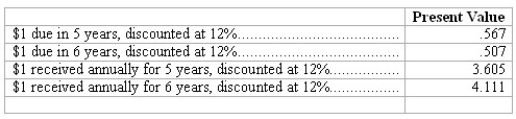

The following information was taken from present value tables:

The following information was taken from present value tables:  All revenue and expenses other than depreciation will be received and paid in cash.The company uses a discount rate of 12% in evaluating all capital investments.

All revenue and expenses other than depreciation will be received and paid in cash.The company uses a discount rate of 12% in evaluating all capital investments.

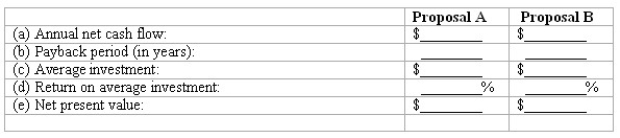

Compute the following for each proposal (round payback period to the nearest tenth of a year and round return on average investment to the nearest tenth of a percent):  (f)Based on your analysis,which proposal appears to be the best investment?

(f)Based on your analysis,which proposal appears to be the best investment?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Redman Company is considering an investment in

Q84: Discounting cash flows

Determine the present value of

Q85: Return on average investment vs.discounting cash flows

The

Q86: When using the net present value method

Q87: Capital budgeting

Carry-Along is debating whether or not

Q89: Capital budgeting computations

A project costing $80,000 has

Q90: Carter & Co.is trying to decide which

Q91: The accuracy of capital budget decisions is

Q92: Capital budget audit

Briefly discuss the reasons that

Q93: Capital budgeting

Flynn Corporation is debating whether to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents