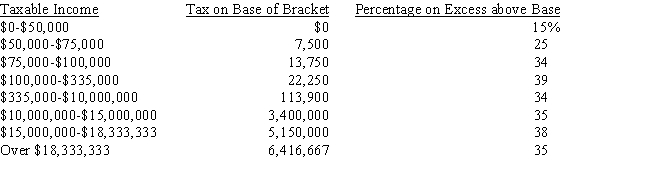

Lintner Beverage Corp.reported the following information from their financial statements:  Calculate Lintner's total tax liability using the corporate tax schedule below:

Calculate Lintner's total tax liability using the corporate tax schedule below:  Assume a 70% dividend exclusion for tax on dividends.

Assume a 70% dividend exclusion for tax on dividends.

A) $2,877,930

B) $3,604,680

C) $2,529,090

D) $2,412,810

E) $2,907,000

Correct Answer:

Verified

Q128: Maureen Smith is a single individual.She claims

Q129: Maureen Smith is a single individual.She claims

Q130: Last year,Martyn Company had $260,000 in taxable

Q131: Alan and Sara Winthrop are a married

Q132: Alan and Sara Winthrop are a married

Q133: Alan and Sara Winthrop are a married

Q134: Maureen Smith is a single individual.She claims

Q136: Bradshaw Beverages began operations in 2011.The table

Q137: Collins Co.began operations in 2012.The company lost

Q138: Maureen Smith is a single individual.She claims

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents