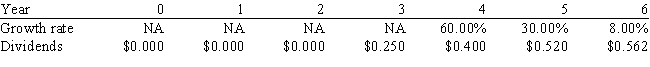

Agarwal Technologies was founded 10 years ago.It has been profitable for the last 5 years,but it has needed all of its earnings to support growth and thus has never paid a dividend.Management has indicated that it plans to pay a $0.25 dividend 3 years from today,then to increase it at a relatively rapid rate for 2 years,and then to increase it at a constant rate of 8.00% thereafter.Management's forecast of the future dividend stream,along with the forecasted growth rates,is shown below.Assuming a required return of 11.00%,what is your estimate of the stock's current value? Use the dividend values provided in the table below for your calculations.Do not round your intermediate calculations.

A) $11.87

B) $11.28

C) $13.65

D) $13.30

E) $12.23

Correct Answer:

Verified

Q79: You must estimate the intrinsic value of

Q80: Carter's preferred stock pays a dividend of

Q81: Church Inc.is presently enjoying relatively high growth

Q82: Savickas Petroleum's stock has a required return

Q83: Your boss,Sally Maloney,treasurer of Fred Clark Enterprises

Q84: The Ramirez Company's last dividend was $1.75.Its

Q85: Wall Inc.forecasts that it will have the

Q86: Huang Company's last dividend was $1.25.The dividend

Q88: Ackert Company's last dividend was $3.00.The dividend

Q89: Nachman Industries just paid a dividend of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents