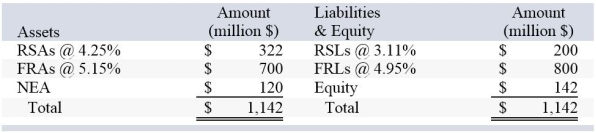

After conducting a rate-sensitive analysis,a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixed-rate assets and liabilities (FRAs and FRLs) ; the rate of return and cost rates on the accounts are also given:  If the bank wishes to set up a swap to totally hedge the interest rate risk,the bank should

If the bank wishes to set up a swap to totally hedge the interest rate risk,the bank should

A) pay a variable rate of interest and receive a fixed rate of interest.

B) pay a fixed rate of interest and receive a variable rate of interest.

C) pay a variable rate of interest and receive a variable rate of interest.

D) pay a fixed rate of interest and receive a fixed rate of interest.

E) None of the options are correct.

Correct Answer:

Verified

Q51: A U.S. bank has deposit liabilities denominated

Q52: A FI buys a $500 million cap

Q53: An FI has DA = 2.45 years

Q54: A regional bank negotiates the purchase of

Q55: Draw a graph of the gains and

Q57: A U.S. firm is earning British pounds

Q58: In terms of direct costs,are futures or

Q59: A FI buys a $500 million cap

Q60: After conducting a rate-sensitive analysis,a bank finds

Q61: A bank wishes to hedge its $25

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents