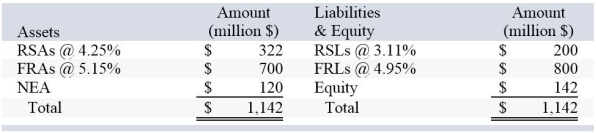

After conducting a rate-sensitive analysis,a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixed-rate assets and liabilities (FRAs and FRLs) ; the rate of return and cost rates on the accounts are also given:  Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap?

Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap?

A) $202,600

B) −$202,600

C) $300,000

D) −$195,200

E) $195,200

Correct Answer:

Verified

Q53: An FI has DA = 2.45 years

Q54: A regional bank negotiates the purchase of

Q55: Draw a graph of the gains and

Q56: After conducting a rate-sensitive analysis,a bank finds

Q57: A U.S. firm is earning British pounds

Q58: In terms of direct costs,are futures or

Q59: A FI buys a $500 million cap

Q61: A bank wishes to hedge its $25

Q62: A bank wishes to reduce its duration

Q63: A $995 million bank has a negative

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents