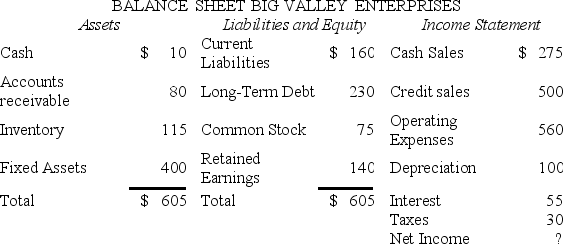

Interest is Big Valley's only fixed cash charge.

Big Valley's market value of equity to book value of debt ratio = 1.5.

Altman's Z-score model is Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 1.0X5.

X1 = Working Capital/Total Assets

X2 = Retained Earnings/Total Assets

X3 = EBIT/Total Assets

X4 = Market Value Equity/Book Value Long-Term Debt

X5 = Sales/Total Assets

Using the Altman's Z model,Big Valley's Z-score is

A) 3.22.

B) 2.88.

C) 2.65.

D) 2.11.

E) 1.85.

Correct Answer:

Verified

Q29: A corporate loan applicant has cash of

Q30: A corporate customer obtains a $1.5 million

Q31: Q32: A firm with a low Z-score has Q33: Individual credit-scoring models typically include all of Q35: The base loan rate accounts for Q36: In analyzing credit risk for a loan Q37: Which one of the following is usually Q38: Q39: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

I. the![]()

![]()