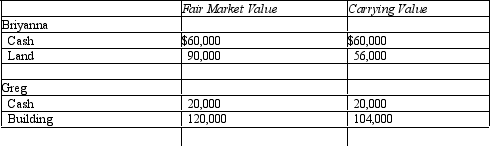

Briyanna and Greg form a partnership and invest the following assets and liabilities.Greg's building is subject to a $40,000 mortgage that is not assumed by the partnership.

In the journal provided prepare the entry to record the formation of the partnership.(Omit explanation.)

In the journal provided prepare the entry to record the formation of the partnership.(Omit explanation.)

Correct Answer:

Verified

Q108: In some liquidations,a partner's share of the

Q119: Joint ventures

A)have become outmoded

B)are a form of

Q120: In a limited partnership

A)the general partners have

Q121: On December 31,20x5,the R & J Partnership

Q122: Justin and Nicole are forming a partnership.What

Q122: Erin,Rachel,and Travis are partners in ERT Company,with

Q123: X,Y,and Z are partners who share profits

Q130: Describe how a dissolution of a partnership

Q138: Discuss how each of the following would

Q139: Warren and Spencer are partners in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents