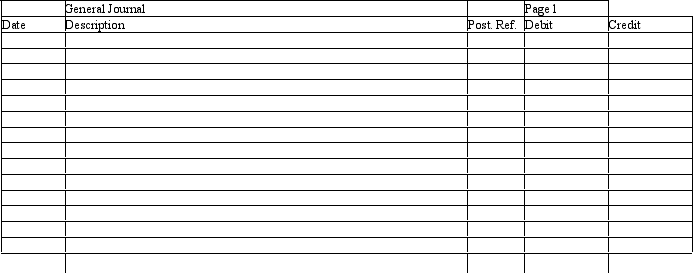

Erin,Rachel,and Travis are partners in ERT Company,with average capital balances for the year of $60,000,$80,000,and $40,000,respectively.They share remaining income and losses in a 2:5:3 ratio,respectively,after each receives a $30,000 salary and 10 percent interest on his or her average capital balance.In the journal provided,prepare the entries without explanations to close income or loss into their Capital accounts,assuming (a)net income of $148,000,(b)net income of $28,000,and (c)net loss of $12,000.

Correct Answer:

Verified

Q108: In some liquidations,a partner's share of the

Q118: Briyanna and Greg form a partnership and

Q121: On December 31,20x5,the R & J Partnership

Q122: Justin and Nicole are forming a partnership.What

Q123: X,Y,and Z are partners who share profits

Q124: Paul,Quinn,and Ralph have equities in a partnership

Q126: Elise,Farrah,and Gina are liquidating their business.They share

Q127: On December 31,20x5,the X&Y Partnership had the

Q130: Describe how a dissolution of a partnership

Q135: Rachel and Dillon divide partnership income and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents