Use the following information to answer this question.

An extract of a company's draft statement of financial position at 30 June 2012 discloses the following:

Plant (at cost) $500 000

Less Accumulated depreciation 300 000 $200 000

On 30 June 2013, the company assessed the fair value of the plant to be $350 000. At 30 June 2014, the carrying amount of the plant was $250 000.

The tax rate is 30%. Depreciation rates are 10% p.a. (accounting) and 12.5% p.a. (tax) using the straight-line method.

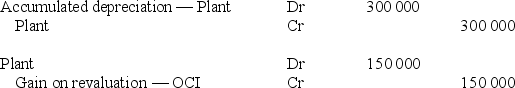

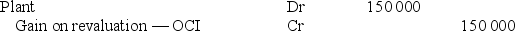

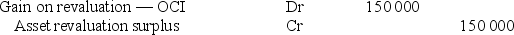

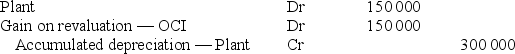

The journal entries necessary to record the revaluation of plant (ignoring any tax effect) at 30 June 2013 in accordance with IAS 16 Property, Plant and Equipment is:

A)

B)

C)

D)

Correct Answer:

Verified

Q3: Revaluations under AASB 116 Property,Plant and Equipment

Q5: Which of the following statements is NOT

Q8: Replicator Limited acquired an item of plant

Q9: The cost of an item of property,

Q11: Jackson Limited acquired a bundle of assets

Q12: The cost of property, plant and equipment

Q13: Troubadour Limited had an existing revaluation surplus

Q14: Use the following information to answer this

Q15: Costs that may be included in the

Q18: Property,plant and equipment includes items that are:

A)intangible

B)held

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents