Use the following information to answer this question.

An extract of a company's draft statement of financial position at 30 June 2012 discloses the following:

Plant (at cost) $500 000

Less accumulated depreciation 300 000 $200 000

On 30 June 2013 the company assessed the fair value of the plant to be $350 000. At 30 June 2014, the carrying amount of the plant was $250 000.

The tax rate is 30%. Depreciation rates are 10% p.a. (accounting) and 12.5% p.a. (tax) using the straight-line method.

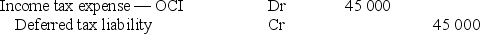

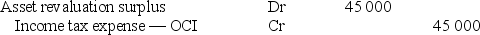

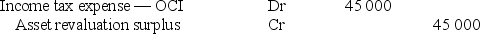

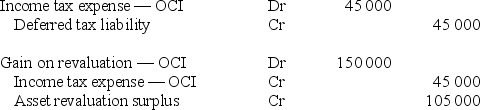

The journal entries to adjust for the tax effect of the revaluation at 30 June 2013 is:

A)

B)

C)

D)

Correct Answer:

Verified

Q2: When an asset is sold the resulting

Q6: Property,plant and equipment are assets that:

A)are expected

Q9: The cost of an item of property,

Q10: Use the following information to answer this

Q11: Jackson Limited acquired a bundle of assets

Q12: The cost of property, plant and equipment

Q13: Troubadour Limited had an existing revaluation surplus

Q15: Costs that may be included in the

Q17: A change in accounting policy from the

Q18: A non-current property, plant and equipment asset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents