Irvington Manufacturing Inc.purchased a new machine on January 2,2014,that was built to perform one function on its assembly line.Data pertaining to this machine are:

Acquisition cost $330,000

Residual value $30,000

Estimated service life:

Years 5

Service hours 250,000

Production output 300,000

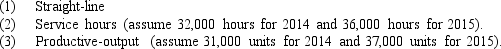

Using each of the following methods,compute the annual depreciation rate and charge for the years ended December 31,2014,and 2015:

Correct Answer:

Verified

Q61: Wastenot is a waste disposal company.Explain the

Q62: Five years ago,Monroe,Inc. ,purchased a patent for

Q63: Which of the following assets generally is

Q64: Pepitone Inc.exchanged a machine costing $400,000 with

Q65: Image Creators,Inc.owns the following equipment and computes

Q67: The impairment test for an intangible asset

Q68: The Corey Company exchanged equipment costing $190,000

Q69: Depreciation is the systematic allocation of historical

Q70: Which of the following assets generally is

Q71: The most recent annual report of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents