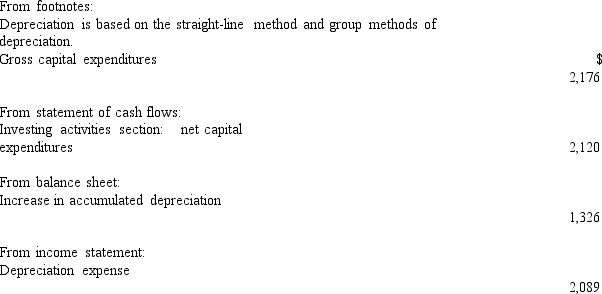

The most recent annual report of the Albondiga Company includes the following information:

(in millions of dollars)

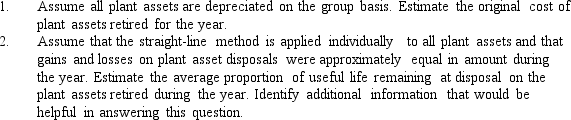

The group method of depreciation treats all assets within a group as having a uniform useful life and applies a depreciation rate based on the total cost of the group.No gain or loss is recognized on disposal under this method.Accumulated depreciation is reduced by the difference between the cost of the assets disposed of and cash proceeds.

The group method of depreciation treats all assets within a group as having a uniform useful life and applies a depreciation rate based on the total cost of the group.No gain or loss is recognized on disposal under this method.Accumulated depreciation is reduced by the difference between the cost of the assets disposed of and cash proceeds.

Required:

Correct Answer:

Verified

Q66: Irvington Manufacturing Inc.purchased a new machine on

Q67: The impairment test for an intangible asset

Q68: The Corey Company exchanged equipment costing $190,000

Q69: Depreciation is the systematic allocation of historical

Q70: Which of the following assets generally is

Q72: The following is a schedule of machinery

Q73: In 2013,Bootcamp Mining Inc.purchased land for $5,600,000

Q74: Algon Company owns a machine that cost

Q75: The impairment test for an intangible asset

Q76: The Fanfare Company applied for and received

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents