The 2014 annual report of Arrowhead Manufacturing Company contained the following notes to the company's financial statements:

Inventory Valuation

The company uses the last-in,first-out (LIFO)cost method of inventory valuation for most domestic manufacturing inventories.Other manufacturing inventories are valued at the lower of standard costs (which approximate average costs),average costs,or market.

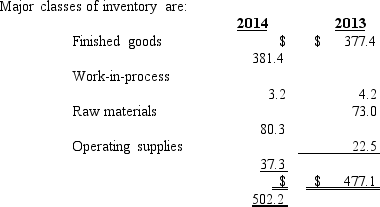

Inventories

If inventories valued on the LIFO basis had been valued at standard or average costs,which approximate current costs,consolidated inventories would be higher than reported by $21.0 million and $19.6 million at December 31,2014,and 2013,respectively.

If inventories valued on the LIFO basis had been valued at standard or average costs,which approximate current costs,consolidated inventories would be higher than reported by $21.0 million and $19.6 million at December 31,2014,and 2013,respectively.

Inventories that are valued at the lower of standard costs (which approximate average costs),average costs,or market at December 31,2014 and 2013,were approximately $185.2 million and $125.7 million,respectively.

Required:

Correct Answer:

Verified

Q111: The skeleton of the basic retail inventory

Q112: The Pistons Company had its entire inventory

Q113: Alana's Clothing Store sells jeans.During January 2014,its

Q114: Management of the Singer Company is currently

Q115: Athletes Sporting Goods began operations February 1,2014.Athletes

Q116: Alana's Clothing Store sells jeans.During January 2014,its

Q117: The following information is available from Carron

Q118: Kendall Company reported the following net income

Q119: At the close of its fiscal year

Q120: The Cleft Music Company was formed on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents