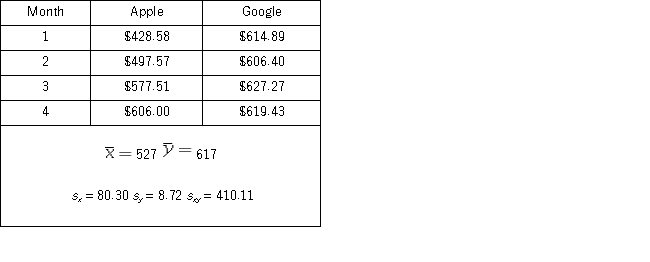

A portfolio manager is interested in reducing the risk of a particular portfolio by including assets that have little,if any,correlation.He wonders whether the stock prices for the firms Apple and Google are correlated.As a very preliminary step,he collects the monthly closing stock price for each firm from January 2012 to April 2012.  a.Compute the sample correlation coefficient.

a.Compute the sample correlation coefficient.

b.Specify the competing hypotheses in order to determine whether the stock prices are correlated.

c.Calculate the value of the test statistic and approximate the corresponding p-value.

d.At the 5% significance level,what is the conclusion to the test? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: When estimating Q120: The following data for five years of Q121: Data was collected for 30 professional tennis Q122: A manager at a ski resort in Q123: A sample of 30 observations provides the Q125: Consider the following sample data.: Q126: An analyst examines the effect that various Q127: An economist examines the relationship between the Q128: A statistics instructor wants to examine the Q129: A researcher analyzes the relationship between amusement![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents