Exhibit 20-1

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

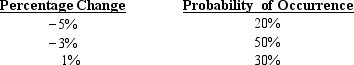

-Maston Corporation has forecasted the value of the Russian ruble as follows for the next year:  If the Russian interest rate is 30%, the expected cost of financing a one-year loan in rubles is:

If the Russian interest rate is 30%, the expected cost of financing a one-year loan in rubles is:

A) 27.14%.

B) 32.86%.

C) 26.10%.

D) none of the above

Correct Answer:

Verified

Q2: Euronotes are unsecured debt securities whose interest

Q6: If all currencies in a financing portfolio

Q29: Exhibit 20-1

Assume a U.S.-based MNC is borrowing

Q30: Exhibit 20-3

Cameron Corporation would like to simultaneously

Q32: Exhibit 20-3

Cameron Corporation would like to simultaneously

Q33: A negative effective financing rate implies that

Q35: _ are free of default risk.

A) Euronotes

B)

Q36: Exhibit 20-1

Assume a U.S.-based MNC is borrowing

Q37: MNCs can use short-term foreign financing to

Q38: Exhibit 20-1

Assume a U.S.-based MNC is borrowing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents