Exhibit 20-3

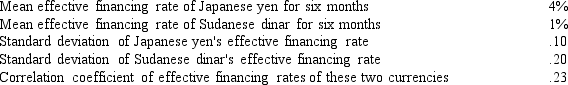

Cameron Corporation would like to simultaneously borrow Japanese yen (¥) and Sudanese dinar (SDD) for a six-month period. Cameron would like to determine the expected financing rate and the variance of a portfolio consisting of 30% yen and 70% dinar. Cameron has gathered the following information:

-Refer to Exhibit 20-3. What is the expected standard deviation of the portfolio contemplated by Cameron?

A) 2.24%.

B) 14.98%.

C) 2.89%.

D) 17.00%.

E) none of the above

Correct Answer:

Verified

Q2: Euronotes are unsecured debt securities whose interest

Q19: One reason an MNC may consider foreign

Q28: Exhibit 20-2

To benefit from the low correlation

Q29: Exhibit 20-1

Assume a U.S.-based MNC is borrowing

Q30: Exhibit 20-3

Cameron Corporation would like to simultaneously

Q33: A negative effective financing rate implies that

Q34: Exhibit 20-1

Assume a U.S.-based MNC is borrowing

Q35: _ are free of default risk.

A) Euronotes

B)

Q36: Exhibit 20-1

Assume a U.S.-based MNC is borrowing

Q37: MNCs can use short-term foreign financing to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents