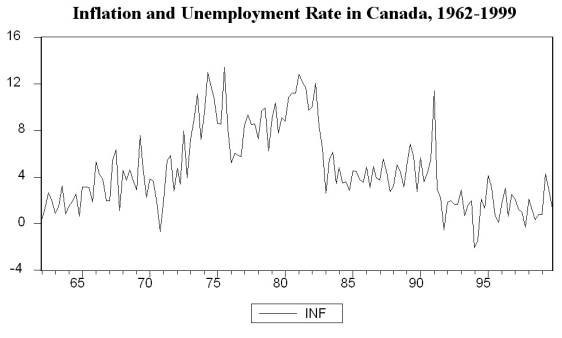

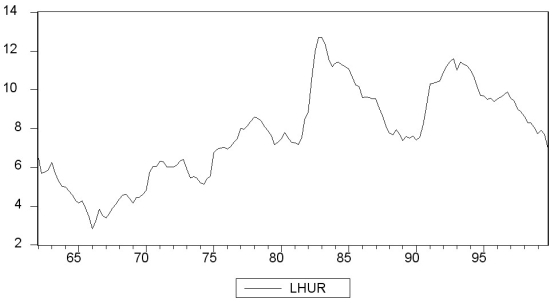

You have collected quarterly data on Canadian unemployment (UrateC)and inflation (InfC)from 1962 to 1999 with the aim to forecast Canadian inflation.

(a)To get a better feel for the data,you first inspect the plots for the series.

Inspecting the Canadian inflation rate plot and having calculated the first autocorrelation to be 0.79 for the sample period,do you suspect that the Canadian inflation rate has a stochastic trend? What more formal methods do you have available to test for a unit root?

Inspecting the Canadian inflation rate plot and having calculated the first autocorrelation to be 0.79 for the sample period,do you suspect that the Canadian inflation rate has a stochastic trend? What more formal methods do you have available to test for a unit root?

(b)You run the following regression,where the numbers in parenthesis are homoskedasticity-only standard errors:  = 0.49- 0.10 Inft-1 - 0.39 △InfCt-1 - 0.33 △InfCt-2 - 0.21 △InfCt-3 + 0.05 △InfCt-4

= 0.49- 0.10 Inft-1 - 0.39 △InfCt-1 - 0.33 △InfCt-2 - 0.21 △InfCt-3 + 0.05 △InfCt-4

(0.28)(0.05)(0.09)(0.09)(0.09)(0.08)

Test for the presence of a stochastic trend.Should you have used heteroskedasticity-robust standard errors? Does the fact that you use quarterly data suggest including four lags in the above regression,or how should you determine the number of lags?

(c)To forecast the Canadian inflation rate for 2000:I,you estimate an AR(1),AR(4),and an ADL(4,1)model for the sample period 1962:I to 1999:IV.The results are as follows:  = 0.002 - 0.31 △InfCt-1

= 0.002 - 0.31 △InfCt-1

(0.014)(0.10)  = 0.021 - 0.46 ΔInfCt-1 - 0.39 ΔInfCt-2 - 0.25 ΔInfCt-3 + 0.03 ΔInfCt-4

= 0.021 - 0.46 ΔInfCt-1 - 0.39 ΔInfCt-2 - 0.25 ΔInfCt-3 + 0.03 ΔInfCt-4

(0.158)(0.10)(0.11)(0.08)(0.07)  = 1.279 - 0.51 ΔInfCt-1 - 0.44 ΔInfCt-2 - 0.30 ΔInfCt-3 - 0.02 ΔInfCt-4

= 1.279 - 0.51 ΔInfCt-1 - 0.44 ΔInfCt-2 - 0.30 ΔInfCt-3 - 0.02 ΔInfCt-4

(0.57)(0.10)(0.11)(0.09)(0.08)

- 0.16 UrateCt-1

(0.07)

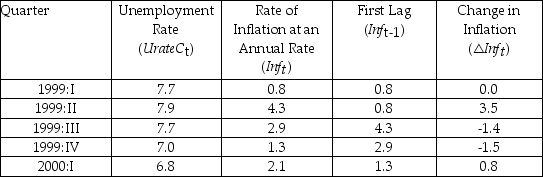

In addition,you have the following information on inflation in Canada during the four quarters of 1999 and the first quarter of 2000:

Inflation and Unemployment in Canada,First Quarter 1999 to First Quarter 2000

For each of the three models,calculate the predicted inflation rate for the period 2000:I and the forecast error.

For each of the three models,calculate the predicted inflation rate for the period 2000:I and the forecast error.

(d)Perform a test on whether or not Canadian unemployment rates Granger-cause the Canadian inflation rate.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: You should use the QLR test for

Q25: Having learned in macroeconomics that consumption depends

Q26: You collect monthly data on the money

Q27: The random walk model is an example

Q29: The textbook displayed the accompanying four economic

Q31: (Requires Internet Access for the test question)

The

Q32: (Requires Appendix material)Define the difference operator Δ

Q34: The Augmented Dickey Fuller (ADF)t-statistic

A)has a normal

Q37: The formulae for the AIC and the

Q38: Statistical inference was a concept that was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents