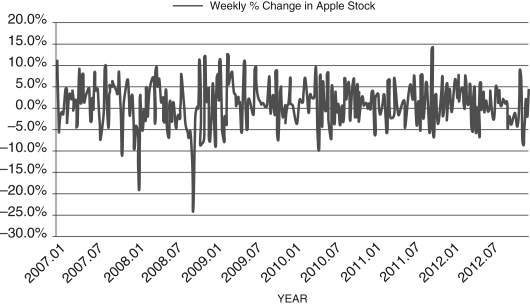

Figure 17.8: Weekly Percent Change in Apple Stock: 2007-2012

-Discuss the relationship between a random walk and informational efficiency in financial assets. Consider Figure 17.8. Given what you know, could you make a case that this market is efficient?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: If the real interest rate is more

Q107: Over the 10-year period from 1997-2005, real

Q108: From the residential arbitrage equation, a rise

Q109: Briefly discuss the different types of investment.

Q110: When Tobin's q is equal to zero,

Q111: If a stock is just as likely

Q112: Nonresidential fixed investment, residential fixed investment, and

Q113: Over the long run, the average P/E

Q114: Tobin's q is the ratio of stock

Q115: Figure 17.7: Price-Earnings Ratio: 1985-2012

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents