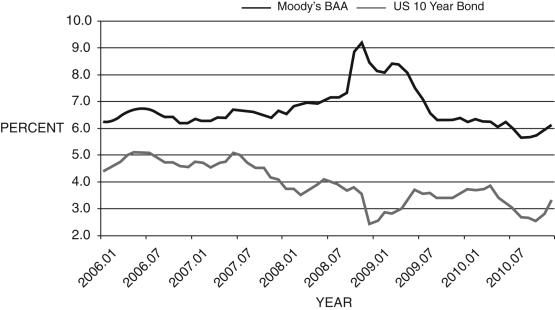

Figure 14.1: BAA and 10-Year Bonds, 2006-2010

-In Figure 14.1 above, the 10-year bond yield is considered ________, while the BAA bond yield represents ________.

A) the federal funds rate; the financial friction

B) the saving rate; the lending rate

C) the financial friction; the prime lending rate

D) a risk-free interest rate; a relatively risky interest rate

E) inflation; the M1 money growth rate

Correct Answer:

Verified

Q9: When a financial friction is added to

Q10: Which of the following represents the AD

Q11: The financial friction is the:

A) difference between

Q12: Figure 14.1: BAA and 10-Year Bonds, 2006-2010

Q13: Figure 14.1: BAA and 10-Year Bonds, 2006-2010

Q15: In response to the financial crisis, the

Q16: In response to the Great Recession, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents