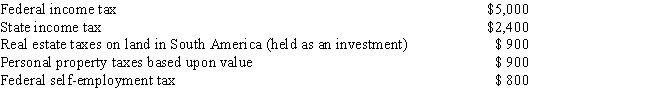

During 2014, Seth, a self-employed individual, paid the following taxes: What amount can Seth claim as an itemized deduction for taxes paid during 2014, assuming he elects to deduct state and local income taxes?

A) $2,400

B) $3,300

C) $4,200

D) $5,000

E) None of the above

Correct Answer:

Verified

Q1: Which of the following is not an

Q37: Randy is advised by his physician to

Q43: Frank is a resident of a state

Q45: Which of the following is not deductible

Q45: During 2014, George, a salaried taxpayer, paid

Q46: Amy paid the following interest expense during

Q92: What is the maximum amount of home

Q101: If the taxpayer fails to locate a

Q104: Expenses of education to improve or maintain

Q115: The cost of uniforms is deductible only

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents