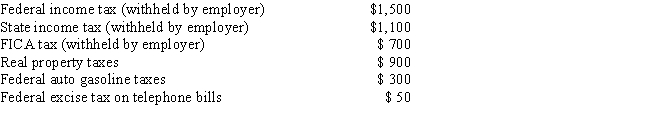

During 2014, George, a salaried taxpayer, paid the following taxes which were not incurred in connection with a trade or business: What amount can George claim for 2014 as an itemized deduction for the taxes paid, assuming he elects to deduct state and local income taxes?

A) $1,100

B) $1,150

C) $1,400

D) $2,000

E) None of the above

Correct Answer:

Verified

Q1: Which of the following is not an

Q41: During 2014, Seth, a self-employed individual, paid

Q43: Frank is a resident of a state

Q46: Amy paid the following interest expense during

Q49: Bill has a mortgage loan on his

Q50: For the year ended December 31, 2014,

Q60: During the current year,Cary and Bill incurred

Q66: Which of the following is not deductible

Q92: What is the maximum amount of home

Q101: If the taxpayer fails to locate a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents