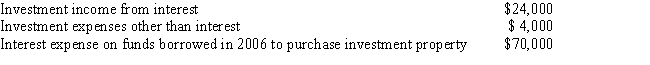

For the year ended December 31, 2014, David, a married taxpayer filing a joint return, reported the following: What is the maximum amount that David can deduct in 2014 as investment interest expense?

A) $7,000

B) $20,000

C) $21,000

D) $24,000

E) None of the above

Correct Answer:

Verified

Q45: During 2014, George, a salaried taxpayer, paid

Q46: Amy paid the following interest expense during

Q49: Bill has a mortgage loan on his

Q51: During 2014, Mr. and Mrs. West paid

Q52: Which of the following interest expense amounts

Q53: Jerry and Ann paid the following amounts

Q55: Harvey itemized deductions on his 2013 income

Q60: During the current year,Cary and Bill incurred

Q62: Which of the following taxes is not

Q66: Which of the following is not deductible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents