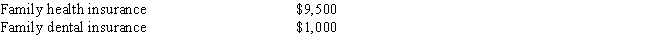

Mike and Rose are married. Mike earns $45,000 from wages and Rose reports $350 on her Schedule C as an artist. Since Mike's work does not offer health insurance, Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Jeremy, age 38, has $25,000 in a

Q64: Mike owns a house that he rents

Q65: Carmen owns a house that she rents

Q66: Miki, who is single and 57 years

Q66: Walt and Jackie rent out their residence

Q67: Moe has a law practice and earns

Q69: Donald rents out his vacation home for

Q71: Christian, a single taxpayer, acquired a rental

Q72: Polly, age 45, participates in her employer's

Q73: Gary and Charlotte incurred the following expenses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents