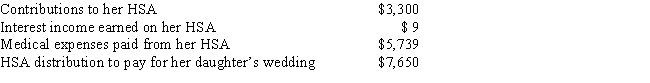

Miki, who is single and 57 years old, has a quaifying high-deductible insurance plan. She had the following transactions with her HSA during the year:

a. How much may Miki claim as a deduction for adjusted gross income?

b. What is the amount that Miki must report on her tax return as income from her HSA?

c. How much is subject to a penalty? What is the penalty percentage?

Correct Answer:

Verified

b. $7,650. The distribution f...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Karen is 48 and a single taxpayer,

Q62: What is the amount of the deductible

Q63: Jeremy, age 38, has $25,000 in a

Q64: Mike owns a house that he rents

Q65: Carmen owns a house that she rents

Q66: Walt and Jackie rent out their residence

Q67: Moe has a law practice and earns

Q68: Mike and Rose are married. Mike earns

Q69: Donald rents out his vacation home for

Q71: Christian, a single taxpayer, acquired a rental

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents