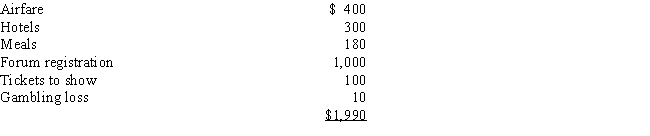

Sally and Martha are tax accountant partners operating a tax firm in San Diego. Every year, they attend the Tax Planning Forum in Las Vegas featuring nationally renowned tax experts. The Forum lasts for 2 days. One evening Sally and Martha attend a show and another evening they lose $10 gambling on the nickel slot machines. Their expenses are as follows:

Calculate the firm's educational expense deduction for the current year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Vinnie has a small retail store and

Q30: Christine is a self-employed tax accountant who

Q70: Carol, a CPA, is always required by

Q77: Indicate which of the following dues, subscriptions,

Q91: Paul is a general contractor. How much

Q92: Mary is an insurance salesperson and a

Q93: Girard is a self-employed marketing consultant who

Q94: Curt is self-employed as a real estate

Q97: Marco makes the following business gifts during

Q99: Dennis, the owner of Dennis Company, incurs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents