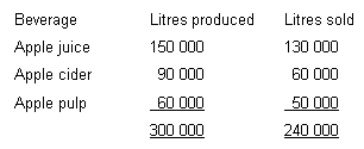

A firm incurs manufacturing costs totalling $240 000 in process 1 to produce the following three beverages emerging from that process at the split-off point.Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre

Apple cider: processed further in Process 2 at an additional cost of $0.66667 litre,then sold for $1.50 litre

Apple pulp: processed further in Process 3 at an additional cost of $1.50 litre,then sold for $3.50 litre

The following data relates to the period in which the joint costs were incurred.What is the amount of joint cost that would be allocated to apple juice if the net realisable value method had been used?

A) $120 000

B) $80 000

C) $84 000

D) $91 000

Correct Answer:

Verified

Q41: When a joint production process results in

Q50: Lipex Pty Ltd produces two products (A

Q52: A firm incurs manufacturing costs totalling $240

Q52: The joint cost allocation method that is

Q53: Lipex Pty c joint process.Each product may

Q54: A chocolate company uses the weight of

Q55: A joint product with very little value

Q56: Which of these statements about joint cost

Q56: Consider a situation where an activity-based costing

Q57: Consider the situation where an activity-based costing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents