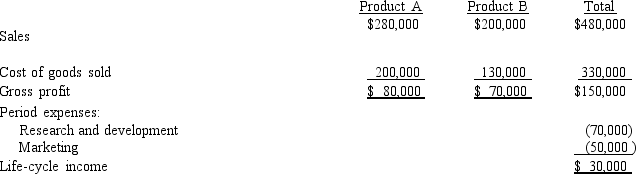

Figure 11-4 The Algonquin Company Developed the Following Budgeted Life-Cycle Income Statement

Figure 11-4

The Algonquin Company developed the following budgeted life-cycle income statement for two proposed products. Each product's life cycle is expected to be two years.

A 10 percent return on sales is required for new products. Because the proposed products did not have a 10

A 10 percent return on sales is required for new products. Because the proposed products did not have a 10

percent return on sales, the products were going to be dropped.

Relative to Product B, Product A requires more research and development costs but fewer resources to market the product. Sixty percent of the research and development costs are traceable to Product A, and 30 percent of the marketing costs are traceable to Product A.

-Refer to Figure 11-4. If research and development costs and marketing costs are traced to each product, life-cycle income for Product A would be

A) $15,000.

B) $23,000.

C) $27,000.

D) $38,000.

Correct Answer:

Verified

Q63: The period of time when sales increase

Q67: Life-cycle cost management consists of

A)actions taken to

Q79: The stage characterized by preproduction and startup

Q80: Figure 11-2

Blue Vibrance Company sells a product

Q81: Luminous Company sells a product for $450

Q83: Figure 11-4

The Algonquin Company developed the following

Q86: Lavalier Company developed the following budgeted life-cycle

Q87: Which of the following is NOT a

Q98: Dot Company sells a product for $225

Q99: The difference between the sales price needed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents