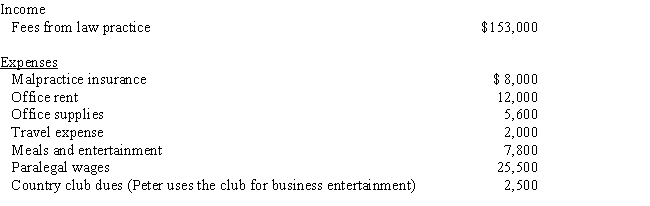

Peter is a self-employed attorney.He gives the following information about his business to his CPA for use in preparing his 2017 tax return:

Peter also drove his car 5,579 miles for business and used the standard mileage method for computing transportation costs.How much will Peter show on his Schedule C for 2017 for:

a.Income

b.Tax deductible expenses

c.Taxable income

Correct Answer:

Verified

Q2: Acacia Company had inventory of $300,000 on

Q6: Brandi operates a small business and employs

Q8: To file a Schedule C-EZ, the taxpayer

Q11: What is the purpose of Schedule C?

Q12: What income tax form does a self-employed

Q12: Lew started a business writing a popular

Q13: Which of the following is not a

Q14: In the current year, Johnice started a

Q15: Schedule C or Schedule C-EZ may be

Q18: Janine is a sole proprietor owning a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents